May 2025 Monthly UK Mortgage Update: What’s New with UK Mortgage Rates?

Plenty has changed behind the scenes this May, especially when it comes to UK mortgage rates.

If you’re thinking about your next move in the housing market, these updates are worth a closer look.

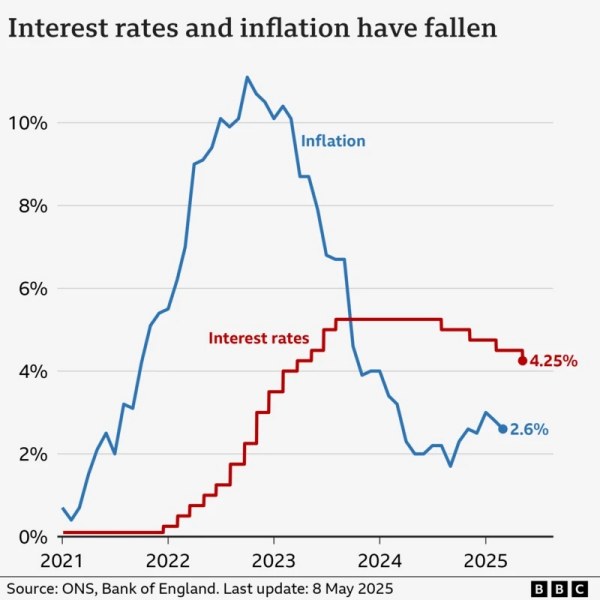

Bank of England Cuts Base Rate to 4.25%

On 8 May 2025, the Bank of England reduced the base interest rate by 0.25 percentage points, bringing it down to 4.25%.

This marks the second rate cut this year, following a reduction in February.

The decision aims to stimulate economic growth amid easing inflation pressures.

House Prices Reach New Highs

The UK housing market continues its upward trajectory:

Average UK house price: £271,000 in March 2025, a 6.4% annual increase.

England: £296,000 (6.7% annual rise).

Wales: £208,000 (3.6% annual rise).

Scotland: £186,000 (4.6% annual rise).

Northern Ireland: £185,000 in Q1 2025, up 9.5% from Q1 2024.

Additionally, the average asking price for homes in Great Britain hit a new record of £379,517 in May, marking the fifth consecutive year of record highs during this month.

Rental Market Trends

Rental prices have also seen significant changes:

- Average UK monthly private rents: Increased by 7.4% to £1,335 in the 12 months to April 2025.

- England: £1,390 (7.5% annual rise).

- Wales: £795 (8.7% annual rise).

- Scotland: £999 (5.1% annual rise).

- Northern Ireland: £843 (7.8% annual rise as of February 2025).

Remortgaging Considerations

With the base rate cut, homeowners approaching the end of their fixed-rate terms may find favourable remortgaging opportunities.

It’s an important time to reassess your mortgage as UK mortgage rates continue to shift across lenders.

- Fixed-rate deals: While new fixed-rate mortgages are becoming more competitive, existing fixed-rate mortgages remain unaffected until the term ends.

- Tracker mortgages: Those on tracker deals will see immediate benefits from the base rate reduction.

- Standard Variable Rates (SVRs): Lenders may adjust SVRs in response to base rate changes, affecting monthly repayments.

Pera Mortgages’ Recommendations

Given the current market dynamics:

- Prospective Buyers: With house prices continuing to rise, securing a mortgage sooner may be advantageous.

- Homeowners: Review your mortgage terms to determine if remortgaging could offer better rates.

- Investors: The rental market’s growth suggests potential for increased yields, but consider regional variations and tenant demand.

Keeping an eye on UK mortgage rates could help you make the most of current deals, especially if you’re approaching the end of your term or considering a new purchase…

Every mortgage journey is different and we’re here to make sure yours is a little smoother, a little clearer, and a lot more supported.

Take care,

Pera Mortgages Team

Looking for more tailored insights?

You might find our Student Mortgage UK Guide helpful, especially if you’re just starting out on your homebuying journey.